idaho estate tax return

You can apply online for this number. Respond rapidly for faster refund.

Tax Return Fake Tax Return Income Tax Return Tax

Before filing Form 1041 you will need to obtain a tax ID number for the estate.

. For other forms in the Form 706 series and for Forms 8892 and 8855 see the. Form PTE-12 Idaho Schedule for Pass-Through Owners. - flyer for Idaho taxpayers 12-19-2019.

Our Income Tax Hub page lists all our income tax resources. A homeowner with the same home value of 250000 in Twin Falls Twin Falls County would be. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

Two the Personal Representative or Trustee may be able to convince the nonfiling nonresident beneficiary to file an Idaho income tax return. Form 40 is the Idaho income tax return for Idaho residents. Also some Idaho residents will receive a one-time tax rebate in 2021.

Page last updated May 21 2019. Before filing Form 1041 you will need to obtain a tax ID number for the estate. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X. This is especially true if the beneficiary lives in a state which has an income tax. For more details on Idaho estate tax requirements for deaths before Jan.

Single under age 65. Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29. Letter to Internal Revenue Service transmitting Federal Estate 346 Tax Return 30.

Last full review of page. If you have general tax questions email the agency at taxreptaxidahogov or call 1-208-334-7660 in the Boise area or 1-800-972-7660. It has offices in the capital Boise and throughout Idaho.

The entity can choose to pay the tax for Idaho nonresident individuals on the entitys composite return. The Idaho State Tax Commission is the government agency responsible for collecting individual income taxes. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

Fiduciary - An automatic six-month extension of time to file is granted until 6 months after the original due date of the return. Idahos income tax rates have been reduced. If the decedent is a US.

For individual income tax rates now range from 1 to 65 and the number of tax brackets dropped from seven to five. Wheres My Refund video. Track refund progress 247.

A homeowner with a property in Boise worth 250000 would then pay 2003 for their annual property taxes. E-File is not available for Idaho. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies without a valid will.

All Major Categories Covered. Sarah FisherMar 03 2020. Non-resident ID state returns are available upon request.

The decedent and their estate are separate taxable entities. Form ID K-1 Partners Shareholders or Beneficiarys Share of Idaho Adjustment Credits. See Idaho Code section 63-3006C Forms and publications.

Letter to Internal Revenue Service transmitting Federal Fiduciary 348 Income Tax Return 32. Yes Estates are required to obtain a Tax ID. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

E-Filing non-resident ID state returns is not available. Direct Deposit is not available for Idaho. An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X.

1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660. Form PTE-01 Idaho Income Tax. Idaho has no state inheritance or estate tax.

The corporate income tax rate is now 65. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801.

Is a Tax ID required for Estates. The gift tax return is due on April 15th following the year in which the gift is made. Enter the total of Idaho distributable income from Form PTE-12 columns b c and e.

Idaho residents must file if their gross income for 2021 is at least. The Estate Tax is a tax on your right to transfer property at your death. 31 rows Generally the estate tax return is due nine months after the date of death.

If the Idaho Fiduciary Income Tax Return Form 66 is filed within the automatic extension period but less than 80 of the current year tax liability or 100 of the total tax paid last year was paid by the original due date an extension penalty will apply. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. We have several resources to help you protect your identity.

County tax rates range throughout the state. Select Popular Legal Forms Packages of Any Category. Our Identity Theft page lists what to do about your taxes if you think youve been targeted.

Letter to IRS requesting prompt audit of estate tax return 347 31. Idaho resident estate or trust is constitutionally questionable. Preparation of a state tax return for Idaho is available for 2995.

House Bill 380 Effective January 1 2021. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Married filing separately.

Instructions are in a separate file. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Citizen or resident and decedents death occurred in 2016 an estate tax return Form 706 must be filed if the gross estate of the decedent increased by the decedents adjusted taxable gifts and specific gift tax exemption is valued at more than the filing threshold for the year of the decedents death.

Include Form PTE-12 with the return if the trust or estate files as a pass-through entity. 7 rows Idaho might require an Idaho individual income tax return Form 40 or Form 43 for the last. The decedent and their estate are separate taxable entities.

Visit our refund status page to get the most up-to-date information on your 2021 tax returnThe refund status graphic tracks a returns progress through four stages. The final Idaho return for the trust or estate. Single age 65 or older.

Line 5 Income Distribution Deduction Enter the amount of the deduction for distributions to beneficiaries. This article goes over topics that include probate how to successfully create a valid will in Idaho and what happens to your property if.

Deducting Property Taxes H R Block

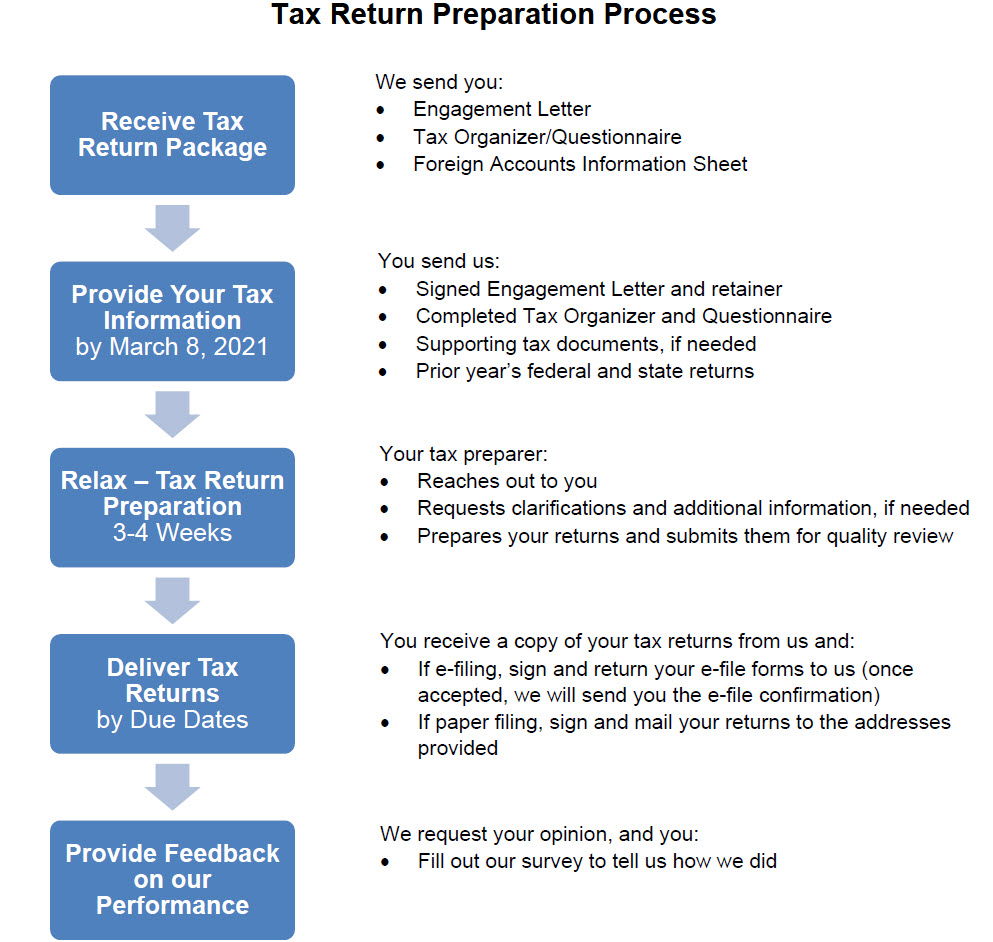

Tax Return Information The Wolf Group

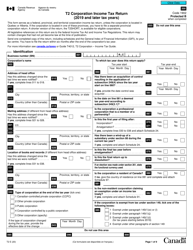

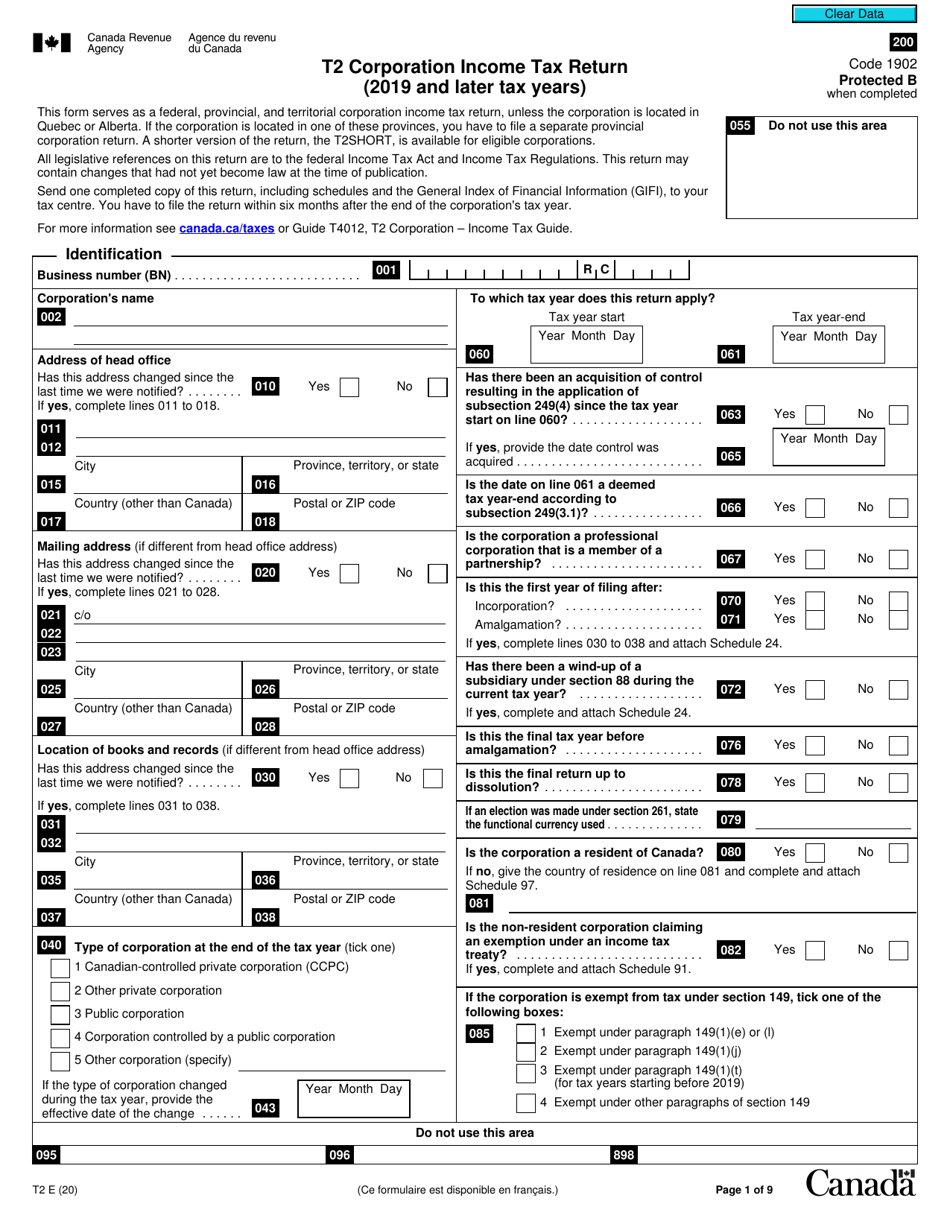

Form T2 Download Fillable Pdf Or Fill Online Corporation Income Tax Return Canada Templateroller

Form T2 Download Fillable Pdf Or Fill Online Corporation Income Tax Return Canada Templateroller

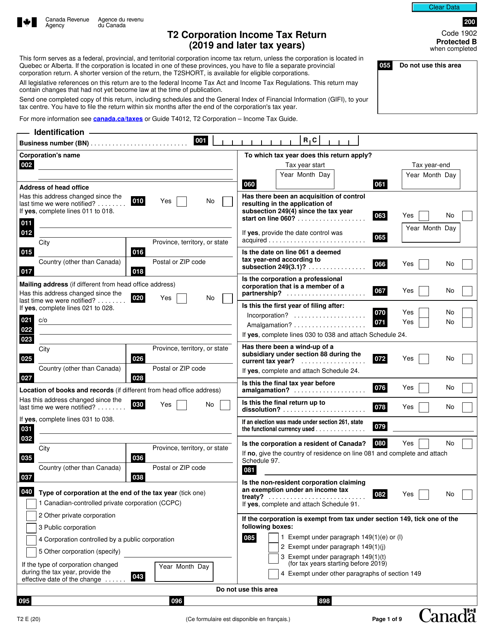

Banking Suvidha Income Tax Return Itr Pan Aadhaar Tax Saving F Personal Injury Lawyer Injury Lawyer Estate Planning Attorney

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Form T2 Download Fillable Pdf Or Fill Online Corporation Income Tax Return Canada Templateroller

Using Your Tax Return To Redecorate A Guest Room Hotpads Blog Guest Room Redecorating Room

You Made A Mistake On Your Tax Return Now What

How To File Taxes For Free In 2022 Money

How Your Idaho Income Tax Refund Can Process Faster Tax Refund Tax Help Income Tax

Tax Memo Is Sugar Baby Income Taxable Chris Whalen Cpa

Tax Form Filling Thetax Form Standard Us Income Tax Return Ad Filling Form Tax Thetax Return Ad Tax Forms Home Equity Debt Consolidation

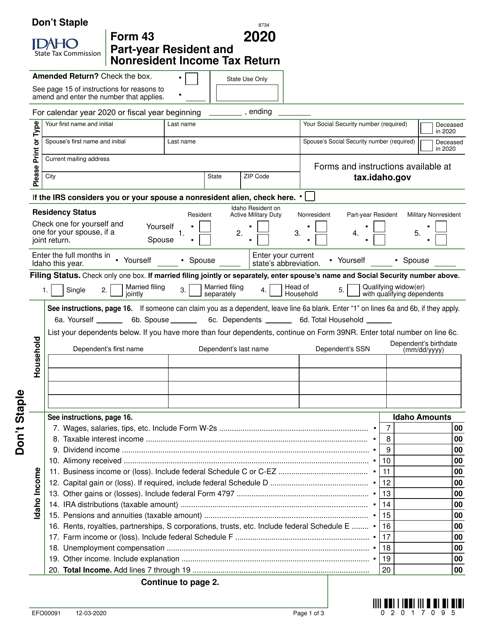

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer